Or call (800) 686-8664

Surety bonds

commercial and contract surety bonds

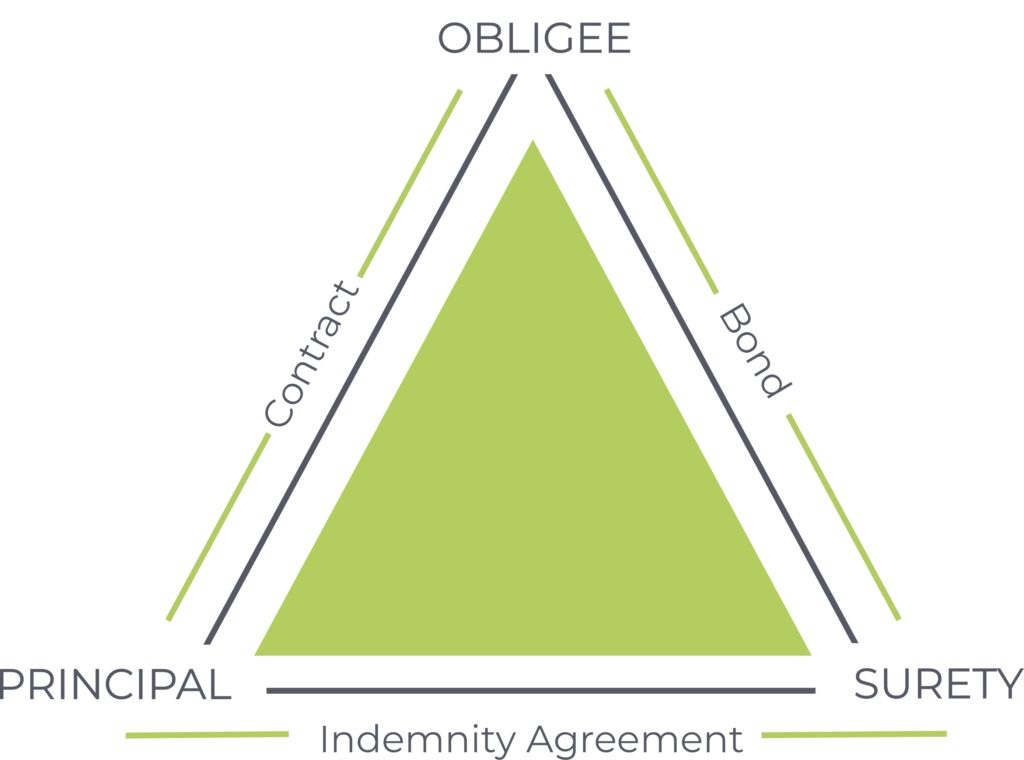

A Surety Bond is an agreement that holds one financially accountable, to carry out the terms of an agreement or contract. In a nutshell, this agreement encourages all parties to act in an ethical and responsible manner until the agreement has been satisfied.

There are many types of bonds you may encounter depending on your industry. Read more about bonds in the guide below, or get started with an expert today!

This surety bond guide will help you:

- Understand what a surety bond is, and why one may be requested

- Learn about the different types of surety bonds.

- Find a ballpark estimate for your Surety Bond.

Surety bonds are widely used in various industries to provide assurance and manage risks. They serve as contractual agreements that offer a level of confidence to clients, customers, and regulatory bodies.

While insurance primarily covers unexpected events and losses, surety bonds focus on guaranteeing the performance or compliance of specific obligations. In simple terms, when someone or a company (called the principal) fails to fulfill their obligation, the surety company steps in and compensates the other party (called the obligee) for any damages or losses up to the bond amount. However, the principal is ultimately responsible for reimbursing the surety company for any payments made.

It’s crucial to note that the requirements and regulations surrounding surety bonds can vary depending on the industry, location, and specific obligations. To navigate the process and obtain the necessary bond for your business, it’s recommended to work with an experienced surety bond provider. They will offer guidance, ensure compliance, and help you secure the appropriate bond that aligns with your business needs and obligations.

Surety bonds can be categorized into different types, each serving a specific purpose. Here are some common types of surety bonds:

CONTRACT BONDS

- Bid Bond or Letter of Intent: Guarantees that a contractor is submitting a bid in good faith and will enter into the contract if awarded the project.

- Performance and Payment Bonds: Ensure satisfactory completion of the project and protect the owner against contractor non-performance and non-payment of labor and materials.

- Supply Bond: Guarantees that a supplier will provide all required materials to the contractor.

- Maintenance Bond: Provides assurance that the workmanship on a project is dependable and covers losses caused by poor workmanship or defective materials for a specified time after completion.

- Subdivision or Improvement Bond: Ensures that the contractor will make required improvements to the property or structures after project completion, often mandated by municipalities for new development projects.

COMMERCIAL SURETY BONDS:

- License and Permit Bonds: Required by state, municipal, or federal regulations for businesses to obtain licenses or permits.

- Court and Judicial Bonds: Promises payment of a specified sum of money required in a court case or legal proceeding.

- Fidelity Bonds: Protects against losses resulting from fraudulent acts by specified individuals, such as employees.

- Public Official Bonds: Provides a financial guarantee that an elected or appointed official will perform their duties faithfully according to the law.

- Notary Bonds: Protects consumers from errors or omissions made by a notary public.

- Miscellaneous Bonds: Includes various non-contract bonds that don’t fit into other categories.

These different types of surety bonds cater to specific needs and obligations within various industries. The type of bond required will depend on factors such as the nature of the project, industry regulations, or legal requirements. Working with a knowledgeable surety bond provider can help you determine the specific bond type that fits your circumstances.

The cost of surety bonds, also known as the bond premium, can vary depending on several factors. The specific bond type, bond amount, and the risk associated with the bond are some of the key factors that influence the cost. Generally, surety bond premiums are calculated as a percentage of the total bond amount.

The bond premium is determined based on the evaluation of the applicant’s financial strength, creditworthiness, and the risk involved in the bond obligation. Applicants with a strong financial profile and a good credit history may be eligible for lower premiums. On the other hand, higher-risk bonds or applicants with less favorable financial credentials may result in higher premiums.

It’s important to note that the percentage can vary significantly between bond types and individual applicants. Some bonds may require a set premium rate, while others may require underwriting and individualized pricing based on the applicant’s specific circumstances.

To get an accurate estimate of the bond cost, it’s recommended to reach out to a surety bond provider. They can evaluate your specific requirements, assess the risk factors, and provide you with a personalized quote for the bond you need.

To obtain a surety bond through our services, simply follow these steps:

Identify Your Bond Needs: Determine the specific type of surety bond you require based on your industry, licensing requirements, or contractual obligations.

Contact Us: Reach out to our experienced team at [Your Company Name]. You can call us or submit a request through our website to get in touch with one of our bond specialists.

Consultation: We will schedule a consultation to discuss your bond requirements in detail. Our experts will guide you through the process, answer any questions you may have, and provide personalized advice based on your specific situation.

Gather Required Information: During the consultation, we will inform you about the necessary information and documentation needed for the bond application. This may include details about your business, financial statements, project specifications, and other relevant information.

Application Assistance: Our team will assist you in completing the surety bond application. We will ensure that all the required information is accurately provided and help streamline the application process.

Underwriting and Quote: Once your application is submitted, we will handle the underwriting process on your behalf. Our team will assess your information, evaluate your risk profile, and determine the bond premium. We will then provide you with a detailed quote for your review.

Bond Execution and Payment: If you decide to move forward with the bond, we will guide you through the necessary steps for bond execution. We will explain the terms and conditions, help you sign the required documents, and facilitate the payment process for the bond premium.

Bond Issuance: After the bond is executed and the premium is paid, we will promptly issue the bond. We will provide you with the official bond document and any additional endorsements or riders as required.

Ongoing Support: Our commitment doesn’t end with bond issuance. We will be available to assist you throughout the bond duration, whether you have questions, need to make changes, or require any additional bonds in the future.

By contacting us directly, you can benefit from our expertise and personalized service to ensure a smooth and efficient surety bond process. We look forward to assisting you and providing you with a competitive quote tailored to your specific bonding needs.